There comes a time in many small companies’ and freelancers’ lives when they want to grow their businesses and reach a new level of sales and profitability. There are four tried and tested ways for freelancers to grow their businesses without too much stress. Deciding how you will grow your business may be the most important decision of your business’s life.

James Cash Penney, the Founder of JCPenney says, “Growth is never by mere chance; it is the result of forces working together.”

There comes a time in almost every successful business when it’s time to broaden your horizons and grow your business. There are four common scenarios for business growth—and we’ll take a look at each of them here. There is also a scenario to which you want to give very careful consideration listed at the end.

Scenario 1: You’ve Hit Peak Earnings – So Branch Out

It doesn’t matter what you do for a living—sooner or later, you’re going to maximize the hourly or project rates that you can get for your work. This is true even when you’re selling value rather than fixed rates. This is your “peak earnings”.

One way to increase your income without hiring anyone or outsourcing is to develop your skills and branch out into new areas. If you can obtain skills that are more valuable to clients—you can sell those skills for more money.

The alternative way to branch out is to start offering your services in a better-paying marketplace. If you do websites for restaurants, they’ll normally have a limit on how much they’ll invest in a website. Tech companies, on the other hand, have much higher budgets for websites. Catering, excuse the pun, for new client groups can be a great way to boost earnings.

This is a great solution for those who enjoy the solo freelance life—and that’s a lot of freelancers. They don’t want to freelance in order to become large company owners; they do it to earn cash and enjoy the way that they live. The “price” of being footloose and fancy free in this sense is the shift in focus from potential big money generation to lifestyle. Time is precious, too.

Author/Copyright holder: Phil Oakley. Copyright terms and licence: CC BY-SA 2.0

Branching out is something that even the biggest companies use to grow. Not every Google product turns into a huge success, but enough do so that they are now one of the biggest technology companies in the world.

Scenario 2: You’ve Hit Peak Earnings – Outsource

Outsourcing can be a good way to increase the capacity of a business without having to hire people (and give them employment rights, etc.).

Given the abundance of freelancing sites such as Upwork and Guru, it’s pretty easy to find outsourcers.

You will need to take this slowly—try small test projects and gauge competencies rather than dumping large projects on unknown quantities.

One of the joys of outsourcing is that if you have a bad month, you won’t be paying salaries and benefits to employees – if you have no work, you’ve no outsourcing to do.

However—conversely—outsourcing requires a greater amount of trust (because of reduced oversight) in the outsourcer than with an employee.

Don’t forget to ensure that you incorporate the costs, not just of the outsourcer but also for your time to manage the outsourcer – otherwise, you may find outsourcing much less profitable than doing it yourself.

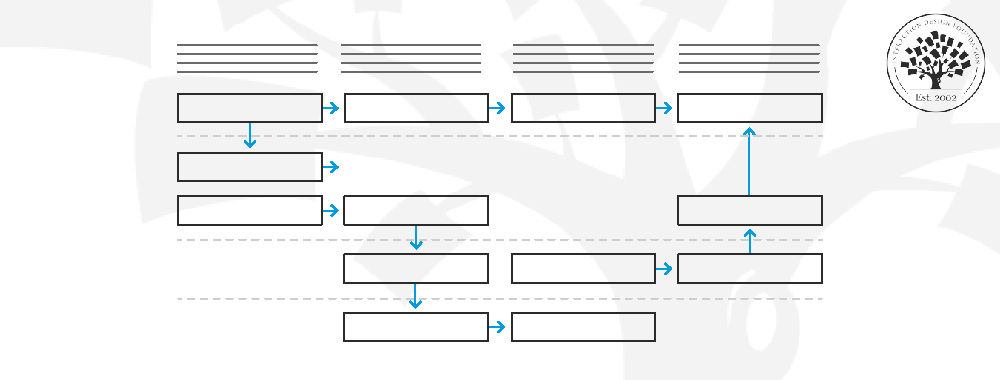

Author/Copyright holder: Sacha Chua. Copyright terms and licence: CC BY 2.0

Author/Copyright holder: Sacha Chua. Copyright terms and licence: CC BY 2.0

Outsourcing decisions can be made at any time. This is a pretty good process for deciding on outsourcing as a freelancer or entrepreneur.

Scenario 3: You’ve Hit Peak Earnings – Partner or Hire

You may decide that you’d rather build a stable practice that isn’t dependent on outsourcing. This will normally involve taking on either an employee (or employees) or some kind of business partner.

Taking on Employees

You need to make yourself familiar with the employment laws of your country. In particular, you need to understand taxes and benefits related to employment. For example, you should carefully research if you as the employer have to pay the employees when they or their children are ill, if they get pregnant, if they get selected for jury duty, if your country requires you to pay for their health insurance, etc.

You need to examine your cash flow and ensure that you at least have enough money to pay the employee(s) for a few months while you scale your business to get enough work for them to make you a profit. Again, don’t forget to ensure that you incorporate the costs, not just of the employee(s) but also for your time to manage anyone you take on. Being a good, motivating, supportive and effective leader is more time-consuming than you might think. You should also take into account that being a leader requires new work tasks for you—meaning you will have to subtract the time working as a manager from the time you will be doing your normal work tasks. Some people love working as leaders and managers. Others are not thriving with the new responsibilities and feel that they have important work time stolen away from them. Overwhelmed by the prospect that they may have bitten off more than they can chew, they’re left feeling stressed and frustrated. You have to figure out the pros and the cons for your freelance business as well as for your working life before you take on an employee. Regardless of your personality type, the impact of involving more than yourself in your concern can suddenly take on unexpected sources of angst. Nevertheless, don’t overlook the potential joys, either.

It may be that it makes more sense to outsource work initially than to take on employees. You can always take on an employee once the volume of work justifies this and cancel the outsourcing arrangement at that point.

If you are going to take on an employee—you must have a specific plan for him or her to add value to your business from the day of hiring. Never stockpile talent in the hope that you might need it “one day”. It’s wasteful and expensive. It also makes for a lousy job for the stockpiled talent to wait around for that “one day”, too.

Author/Copyright holder: Pixabay. Copyright terms and licence: CC0

Author/Copyright holder: Pixabay. Copyright terms and licence: CC0

Hiring can bring both opportunities and threats to your business – make sure you’ve thought the process through carefully before bringing on employees.

Taking on a Partner

In his book, The Bootstrapper’s Bible, Seth Godin, MBA, business consultant and successful author, strongly advises against partnerships unless there are clear benefits and a very well-defined set of requirements from partners. He strongly advises having an exit strategy from any partnership. He also advises you to explore alternatives before going into partnership. He notes that giving away half your business to a partner can end up being a lot more expensive than hiring an employee.

An American sales manager was the Vice-President of a huge blue-chip company in Asia. When he left that company, he set up a freelance consulting company. His first client was based in Taiwan. They asked him how much he wanted paying, and he said, “$25,000 a month plus expenses.”

They thought about it. They decided this was too much and told him so. So, he suggested something different. The sales manager pointed out that their share price was next to nothing and asked for 10% of their shares, and he would cover his own costs. They agreed, and he went to work with his sales magic.

The shares today are worth more than 500 times what they were worth to that company when the sales manager did his deal. His slice is now worth nearly $20 million.

When the CEO of that company was asked to pick the biggest mistake he had ever made in his business life, he laughed and said: “Paying the sales manager in shares. We were too focused on the initial cost and didn’t pay enough attention to the long-term implications.”

The sales manager now spends a couple of hours a month working for that company. His initial contract only lasted six months. He’s done very well from that deal. The company themselves, on the other hand, have found out just how expensive a partnership can be.

If you do decide a partnership is right for you—take both financial and legal advice from accountants and lawyers and ensure that you have a strategy to maximize the value of a partnership.

Scenario 4: You’ve Hit Peak Earnings – Develop Products for Sale– Passive Income

Our final common way to develop a business is simple—come up with a product for sale and sell that. The biggest constraint for most freelancers is that there’s only them in their business. Once they reach their maximum order book (be it 40/60/80 hours a week), they cannot sell any more services without outsourcing, employing people, or taking a partner. The laws of nature will intervene, no matter how die-hard or strong-willed a sole trader. The costs of taking on too much alone can be disastrous—health, social relationships, and let’s not forget reputation when mistakes start happening.

However, if they were to create a product (for example, a book that details how to do what they do or a website theme for WordPress), there’d be no limit on the number of products they could sell. This would be a comfortably far cry from the risk of burning out in “the trenches”, and more profitable.

In fact, these products (if developed and marketed correctly) can sell while you sleep, too. Passive income is an income received on a regular basis, with little effort required to maintain it. Now, before you aim for the couch or imagine yourself lying under a palm tree while envisioning the money rolling into your bank account, you should know that the highly celebrated radical idea of “passive income” is nonsense. You will always have to do some work to improve and sell your products. Passive income does not mean effortlessly coining it in.

Pat Flynn is an American entrepreneur, blogger and podcaster known for his popular website Smart Passive Income. Flynn defines passive income as:

“... building online businesses that take advantage of systems of automations that allow transactions, cash flow and growth without requiring a real-time presence. We don’t have to trade our time for money one to one. Instead, we invest our time upfront, creating valuable products and experiences for people, and we reap the benefits of that time invested later...It’s not easy. I just want to make sure that’s clear.”

– Pat Flynn

Flynn does not make creating passive income sound easy. It requires a serious ramp-up. He advises you to spend 80- to 100-hour workweeks in the beginning. But once you’ve got your product up and running, you can expect much less and—in some cases—fairly minimal maintenance. It, of course, depends on the product. Some sites such as Green Exam Academy, the LEED exam study site Flynn launched in 2008, take him only four to five hours a month to maintain but bring in $250,000 annually.

Here are expert Pat Flynn’s 10 best tips which can help you get started generating your own passive income:

Before you begin, ask yourself, “Am I doing this just for the money?”

Be prepared to put in serious time upfront.

Banish the thought that once you’ve created the product, you can sit back and buff your nails.

Still want to do this? Then find a market you can help.

Before you dive in, consider whether you’d be happy serving this market several years from now.

Find out how that audience is already being served — and what gap you can fill.

Build your platform.

Offer them value for free.

Figure out what product will best serve them.

As you start to make money, remember tip 1 — that profit shouldn’t be your main motivation.

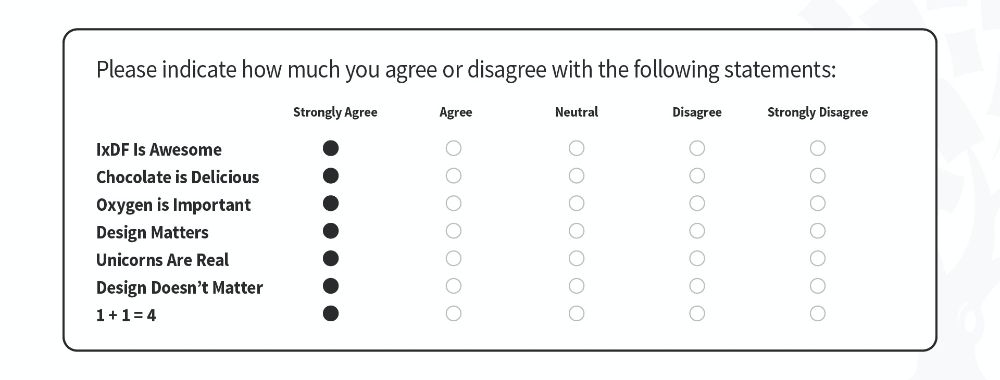

Author/Copyright holder: Rikke Friis Dam and the Interaction Design Foundation. Copyright terms and licence: CC BY-NC-ND.

Author/Copyright holder: Rikke Friis Dam and the Interaction Design Foundation. Copyright terms and licence: CC BY-NC-ND.

Passive income doesn’t mean that you can lie back and relax. You will always have to do some work to improve and sell your products. Passive income does not mean effortless income, especially not in the beginning.

The Danger Scenario – Single Client-based Expansion

One of the most common causes of business failure is expanding too fast. This often occurs because a single client offers an incredible project—for example, they arrive with an order for $2 million at the door of your $150,000-a-year business.

It’s normal to see this as a huge opportunity; if you’re successful – it may mean taking your business to a whole new level. However, it’s also a huge risk; if the client pulls out of their contract, you don’t have the income or clients to support the loss – if you’ve hired people, hired new offices, etc. to deliver the contract, you may find this loss leaving you bankrupt.

Sometimes, it’s better to walk away from an expansion opportunity rather than to leave your business overexposed to risk. If you find yourself in this position, take legal and financial advice before committing to anything.

The Take Away

It’s natural to want to expand your business and your earning potential. It’s one of the joys of being a business owner – you can almost earn as much as you want to—if you’re dedicated, persistent, highly qualified, take chances and work hard.

There are four tried and tested ways to grow a freelance business or small company: branch out, outsource, partner or hire, or develop products for sale.

However, you should choose your expansion strategy carefully, and if there’s a lot of risk involved (e.g., partnering or single-client dependence) you should always seek legal and financial advice.

References & Where to Learn More

Hero Image: Author/Copyright holder: Bambi Corro III. Copyright terms and licence: CC BY-ND 2.0

Paul Hawken, Growing a Business, 1988

Pat Flynn’s blog on passive income.

10 Top Tips on Passive Income from Expert Pat Flynn, Laura Shin, 2014

And here: 10 Great Ideas for Growing Business Now